20 21 KANTE GIROUD Maglie Da Calcio Da Uomo PULISIC PEDRO MORATA WILLIAN FABREGAS JORGINHO Home Away 3rd Maglie Da Calcio Uniformi Manica Corta Da 11,56 € | DHgate

NUOVE Maglie Da Calcio Palmeiras 23 24 Campioni Campeao Brasileiro 2023 2024 Hendecacampeao L. ADRIANO RAMIRES DUDO GOMEZ Veiga Willian Roni Maglie Da Calcio MELO POLO 6 من 56.71ر.س | DHgate

Willian's Arsenal shirt number announced as forward follows in Thierry Henry's footsteps - Daily Star

NUOVE Maglie Da Calcio Palmeiras 23 24 Campioni Campeao Brasileiro 2023 2024 Hendecacampeao L. ADRIANO RAMIRES DUDO GOMEZ Veiga Willian Roni Maglie Da Calcio MELO POLO 6 من 56.71ر.س | DHgate

2004 Panini Calcio 柳沢敦 ジャージーカード ☆ 元日本代表 鹿島アントラーズ 京都サンガFC ベガルタ仙台 (A) | JChere Yahoo Auction Proxy Purchasing

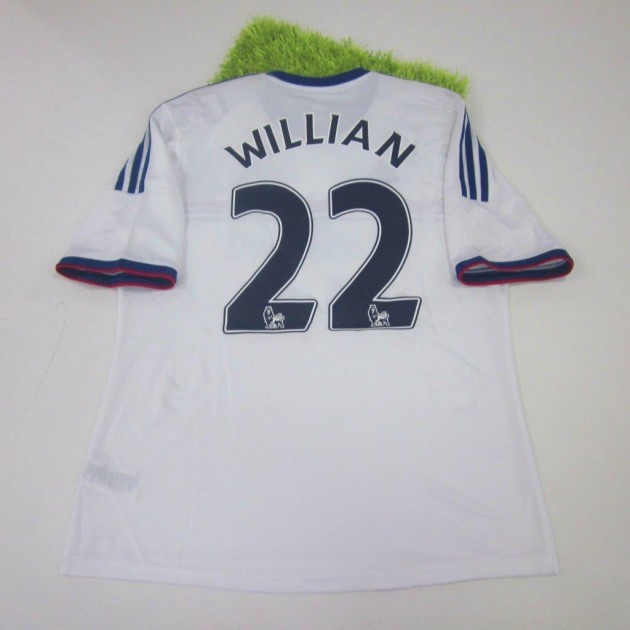

Uomo 2016 – 2017 Willian # 22 maglia da calcio da trasferta, LS Home, M : Amazon.it: Sport e tempo libero