Champagne & Sparkling Wines Masterclass — Wine Tasting Bristol & Bath | Bristol Wine School | Wine Courses Bristol & Bath

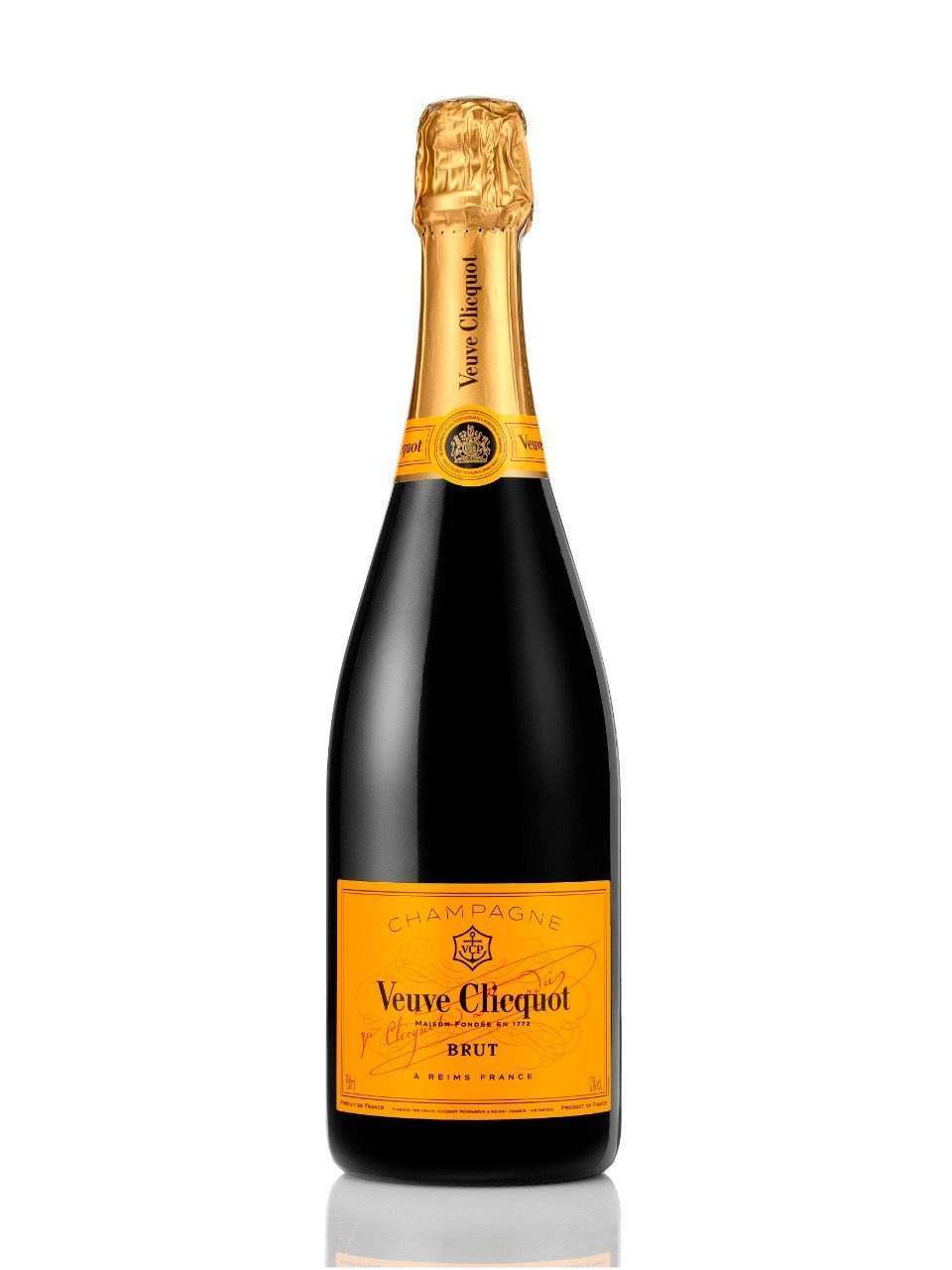

Buy Champagne Online @Lowest Prices (Best Gifts + Same Day Delivery*) | Top Champagne Brands - Dan Murphy's

5 expert Champagne tips to make you look like a pro at your next celebration - Wine + Champagne - delicious.com.au

No, putting a spoon in an open bottle of champagne doesn't keep it bubbly – but there is a better way | Australian food and drink | The Guardian

Celebration With Splashes Of Champagne Stock Photo - Download Image Now - Champagne, Bottle, Exploding - iStock

:max_bytes(150000):strip_icc()/LIQUORS-16-best-champagnes-4942483-recirc-a65aa62104ac4626b4f3077812f0a13b.jpg)