Amazon.com: America's Serial Killers: Portraits in Evil : Charles Manson, Ted Bundy, Jeffrey Dahmer, John Wayne Gacy, Various: Movies & TV

Amazon.com: The Ultimate Serial Killer Collection: True Crime Stories and Biographies of Ted Bundy, Jeffrey Dahmer, Zodiac Killer, Jack the Ripper, John Wayne Gacy, Richard Ramirez, Edmund Kemper, Manson, & more eBook :

Amazon.com: Ed Gein , Dahmer , Ted Bundy , Gacy : Serial Killer 4 Disc Box Set : Adam Baldwin, Mark Holton: Movies & TV

The Three Murderers | South Park Character / Location / User talk etc | Official South Park Studios Wiki

Serial killers Ted Bundy, Jeffrey Dahmer, Albert DeSalvo, "Son of Sam," & John Wayne Gacy are among the infamous crimin... | FoxNashville | Scoopnest

Fiends Charles Manson David Berkowitz Henry Lee Lucas Jeffrey Dahmer John Wayne Gacy Richard Ramirez Richard Speck Ted Bundy shirt, hoodie, sweater, long sleeve and tank top

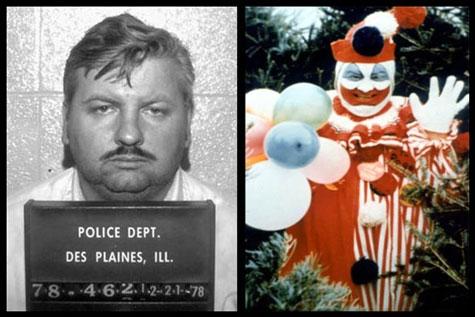

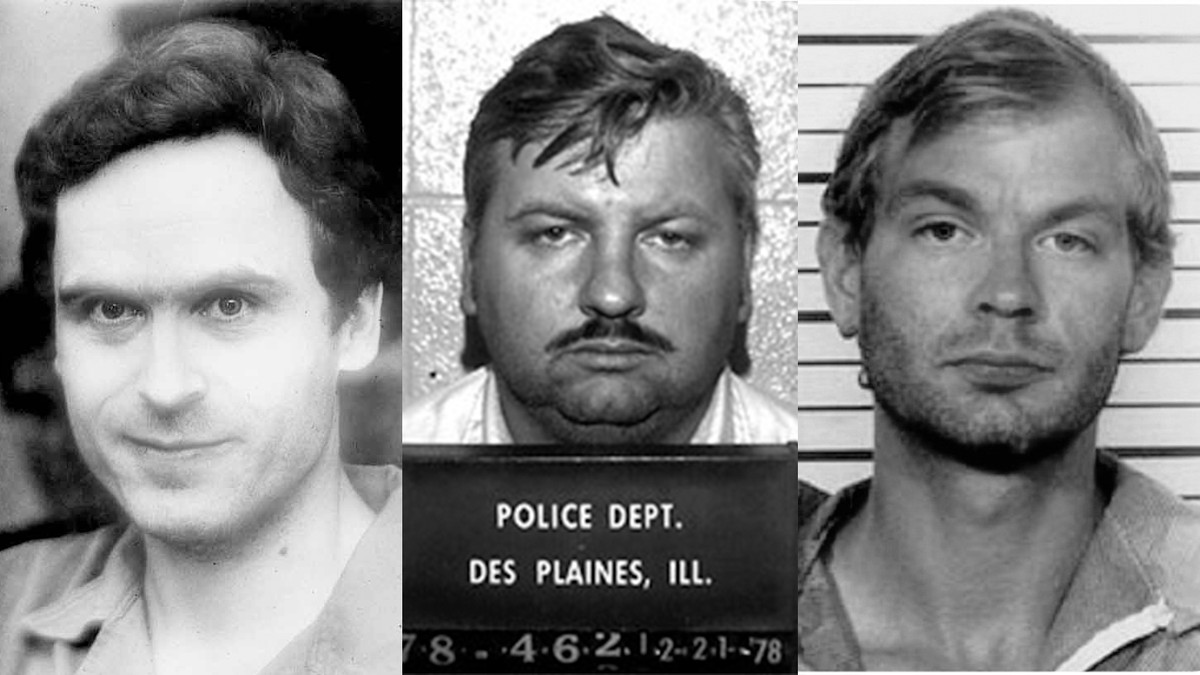

John Wayne Gacy, Jeffrey Dahmer and Others: Ranking Serial Killers on a Scale of Evil - A&E True Crime